All expenditures that post to sponsored projects should be allowable, allocable, reasonable, and consistently treated as described in Uniform Guidance 2 CFR Part 200 and Cost Accounting Standards (CAS). To ensure audit-readiness and compliance with applicable policies, ORSPA’s Fiscal Compliance Team will provide monthly tips and reminders to help units strengthen their internal Post-Award processes.

Post-Award Tips and Reminders Newsletter

- Use of the wrong Spend Category or Ledger Account – Sometimes units will incorrectly select the “Transfers Out” or “Transfers In” Ledger accounts to move an expense off/on to a grant account. The Transfer Out/In ledger accounts move revenue. A non-payroll cost transfer is the reallocation of an expenditure, not of revenue. Instead of using Transfers Out/In, units should use the spend category/ledger account that best describes the expense being transferred (i.e. Materials and Supplies).

- Moving Administrative Services Charge – When creating an accounting journal to move an expense from a program account to a grant account, some units will include the Administrative Services Charge in the transaction. As a reminder, units only need to move direct costs. Refer to the February 2021 Post-Award Tips and Reminders Newsletter for more information.

- It provides an audit trail connecting the original journal lines to the corrected journal lines

- Validates the accounting string data of the original entry for reversal

- Ensures you do not move an entry more than once

Departmental Grant P-Cards and GRT Dummy Grant Accounts

Units are reminded that P-Cards do not allow for the allocation of charges between grant and non-grant accounts within PaymentNet. Consequently, grant P-Card purchases should be made with a grant P-Card to avoid the need for cost transfers. For those units who do not want to request a unique P-Card for each grant, but do want the ability to use the Payment Net allocation functionality, there is the option to request a departmental grant P-Card. This allows units to make grant P-Card purchases on a single card and then use the PaymentNet functionality to allocate charges across grant accounts prior to posting in Workday. For more information on Departmental Grant P-Cards, see the Research Admin website.Human Subject Payments Best Practices

Human Subject payments on sponsored projects should only be charged to sponsored projects with active IRB approval. As best practice, business operations staff are encouraged to ask individuals requesting Human Subject Payments to provide the approved IRB protocol number and include that identifier in the Memo Field of Spend Authorizations and Supplier Invoices as appropriate. Additionally, units are reminded that Workday has two Spend Categories to help units properly code Human Subject Payments:- SC0755 Subject Pay Stipends >$100

- SC0754 Subject Pay Stipends $100 or less

Back-Up Documentation Best Practices

As a reminder, backup documentation for sponsored expenditures should speak for itself. Documentation tells the story of what transpired during a project period. When a project ends, the file should stand on its own. There should be no need for any additional explanation of any transaction or event beyond what is already on file as part of the transaction. Additionally, units are reminded that any and all backup documentation included with a transaction is eligible for review in the event of an audit. With that in mind, we wanted to share some best practices for selecting backup documentation:- Fiscal Delegate Approval - If a project has an approved Fiscal Delegate on file with ORSPA, and the Fiscal Delegate is managing transaction approvals, it is recommended to include a note in the memo field of the transaction stating that approval was provided by the Fiscal Delegate and the name of the Fiscal Delegate. Additionally, units are also encouraged to upload a copy of the approved Fiscal Delegate Form to the transaction.

- Email Conversations - When using email conversations as backup documentation, units should make sure that the email chain is succinct, relevant and clearly demonstrates that a transaction is allowable, reasonable and allocable. If email attachments are too extensive or deal with multiple topics that might not be related to the transaction in question, it could potentially raise more questions about the transaction rather than support it. If an email conversation regarding a particular transaction extends for too long, it would be advisable to create a new email thread summarizing only the relevant elements that support the transaction and use that as backup documentation instead.

- Proposal and Award Documents - Units are encouraged to use proposal and award documents as backup documentation for transactions coded to protected budget categories such as capital equipment, foreign travel and CAS exception. If using proposal and award documents, units should only upload the relevant page(s) that show that the item has been approved by the sponsor. For example, rather than upload a full copy of the submitted proposal, the unit should only upload the page(s) from the budget justification and highlight the section that supports the transaction. The same practice should be followed when using award documents.

As best practice, units are encouraged to provide strong justifications when processing expenses that would be considered an exemption to our Cost Accounting Standards such as General Supplies and Postage. Ways to document CAS exceptions are as follows:

- If the item being purchased was explicitly included in the approved proposal budget, upload a copy of the proposal budget justification highlighting the item.

- If the need to purchase an item considered a CAS exception came up after the award was made, and the CAS exemption was reviewed/approved by the Award Management Team* include the justification and AMT approval.

- If the need to purchase an item considered a CAS exception came up after the award was made, the unit should include a justification that addresses the following:

- How the item benefits the project

- Why the project cannot be properly executed without the item

- Include the eligible CAS exception category (available here) the project falls under.

*Post-award CAS exceptions are not required to be reviewed and approved by AMT. The unit will need to evaluate each cost on a transaction by transaction basis to determine whether it is an allowable CAS exception item. If a unit is unsure that the expenditure is allowable, they may submit their justification for a CAS exception for review and approval by emailing their AMT Award Monitoring GCO. The unit is responsible for maintaining all required documentation related to costs meeting the CAS exception criteria.

Additional Resources for CAS Exceptions

Fabricated Equipment

Fabrication of capital equipment sometimes requires purchases of numerous non-capital items which may be spread out across multiple transactions. As a way to easily identify all the components of the fabricated equipment, units are encouraged to include the asset number in the memo line in Workday.

Expense Items and Spend Authorizations

Units wanting to process a cash advance must create a Spend Authorization in Workday. Per the Spend Authorization Work Instructions, initiators must select the “Cash Advance” Worktag as the “Expense Item.” To settle a cash advance, departments must create an Expense Report following the Expense Report for Spend Authorization Cash Advance Work Instructions. When creating the Expense Report to settle the advance, units should not select “Cash Advance” as the Expense Item (spend category). The Expense Item on the Expense Report should be representative of the items purchased with the Cash Advance.

P-Card Reminders

As a reminder, users have 5 business days to go into PaymentNet to change/add Worktags for proper reporting including the Spend Category. If users are unable to make the appropriate updates in PaymentNet during the 5-business day window, corrections will need to be managed via an Accounting Journal. Units are encouraged to review the Financial Services Best Practices for P-Cards.Food Purchases

Units processing food purchases on sponsored projects should be familiar with ASU's Financial Services Manual FIN 420-02: Business Meals, Food, and Related Expenses. Some useful excerpts from the policy are included below:- Since business meals, food and related expenses are often not appropriate on sponsored grants, confer with your Sponsored Projects administrator before making any commitment of funds for this purpose. Business meals, food, and related expenses cannot be charged to sponsored grant, unless specifically authorized by the grant or contract.

- Meal expense reimbursements to interviewees while in travel status for an interviewee’s own meals incurred during a visit to ASU, but not the meals of any ASU faculty or staff to have a business meal with the interviewee.

- Meal expense reimbursements to guest lecturers, consultants, and other independent contractors while in travel status, but not the meals of any ASU faculty or staff to have a business meal with a guest lecturer, consultant, or other independent contractor.

- No External Party:

-

- If no external party is present at the business meal, i.e., all are ASU employed personnel, the ASU person authorizing the food expense must clearly justify why such an expense is appropriate.

- Examples of appropriate food expenses where only ASU employees are in attendance:

-

-

-

-

-

-

- departmental workshop where the group was together over lunch in order to build a cohesive working team;

- appreciation to a group of ASU staff upon completion of a special project or in recognition of a commendable accomplishment; and

- search committee meeting during a mealtime when there is no other time to get the search committee together

-

-

-

-

-

-

- Examples of when a food expenditure is not acceptable: Frequent lunches for the same two ASU employees who meet often to discuss university business, e.g., several times a month.

-

Business Purpose for Grant Expenditures

Units are reminded that Financial Services requires clear documentation of the public purpose served by every ASU expenditure as a way to fulfill ASU’s fiduciary requirements outlined in FIN 119: Public Purpose Served.

To help units develop audit-ready business purposes for their transactions, we want to share the KE Financial Services Public Purpose Guide. This guide was developed by KE Financial Services for internal use but was approved for use by ASU’s Financial Services (on 01/06/20) and ORSPA’s Fiscal Oversight (12/19/2019). Units are highly encouraged to adopt this guide for both sponsored and non-sponsored transactions.

Participant Support vs Research Subject Pay

Before issuing payments for Participant Support and Research Subject Pay, units are advised to confirm the payee’s role on the project with the PI. As a reminder, Participant Support and Research Subject Pay are two separate expenditure categories and should be applied based on the person’s role on the project. For reference, the definition for Participant Support and Research Subject Pay are included below:

Participant Support: Participant support costs means direct costs for items such as stipends or subsistence allowances, travel allowances, and registration fees paid to or on behalf of participants or trainees (but not employees) in connection with conferences, or training project.

Research Subject Pay: Incentive payments to encourage individuals to participate in research study and provide private data/information through intervention or interaction. This includes participation in surveys and interviews.

Additional Resources:

Expenditure Coding in Workday

Workday has hundreds of available Spend Categories to choose from, sometimes making it challenging for the business contact to select the right one. To help units better identify the correct Spend Category, units are encouraged to use the Ledger Account to Revenue and Spend Category Crosswalk report in Workday. With this report you can easily view the Ledger Account and revenue/spend category relationship. For example, you can view all the Spend Categories associated with Ledger Account 7202: Materials and Supplies:

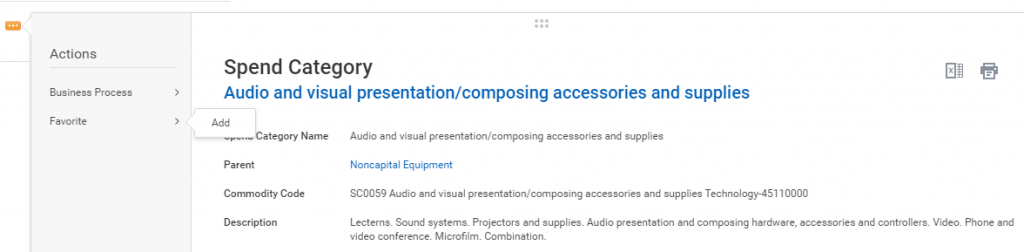

Additionally, units are reminded that you can see the full description of a Spend Category by hovering over the Spend Category and clicking on the ellipsis located on the right side: